Ga payroll calculator 2023

Ad Compare This Years Top 5 Free Payroll Software. Based Specialists Who Know You Your Business by Name.

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

All Services Backed by Tax Guarantee.

. All Services Backed by Tax Guarantee. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Georgia Paycheck Calculator 2021 - 2022.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

For an overview of PACT watch our Introduction to the Pay and. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. Each state also has. Ad Compare This Years Top 5 Free Payroll Software.

For more details learn more about. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Employers can enter an.

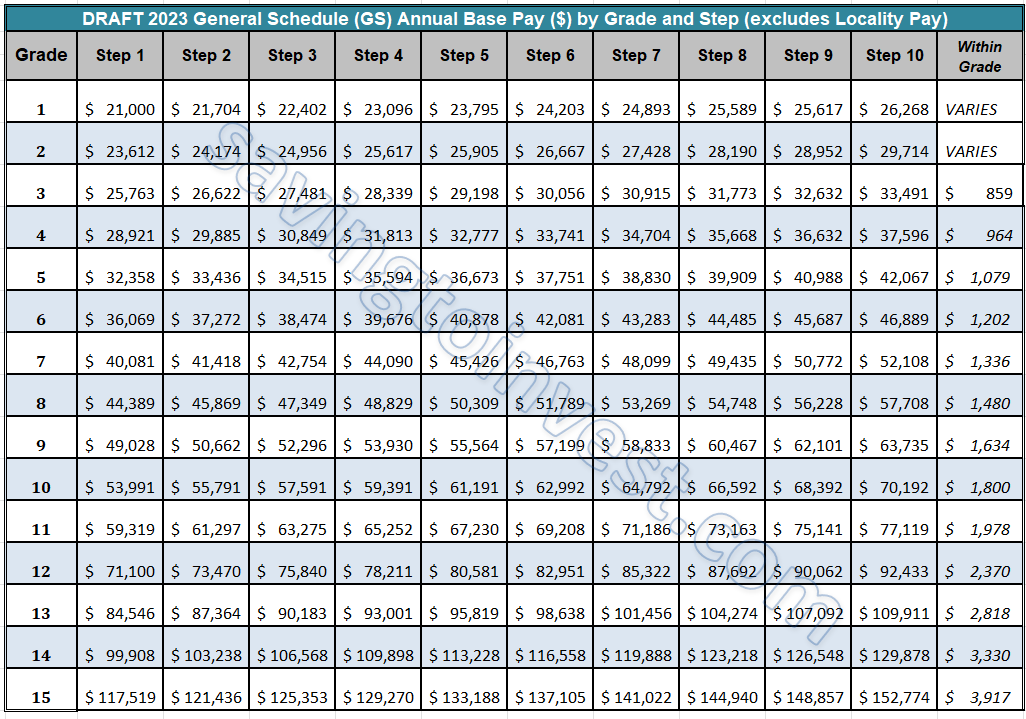

The yearly base salaries of General Schedule employees in Atlanta can be determined from the 2022 pay chart below based on their GS Grade and Step. Figure out your filing status work out your adjusted gross income. Dont forget to increase the rate for any overtime hours.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The Illinois Paycheck Calculator uses Illinois. Calculate Gross Wages.

The standard FUTA tax rate is 6 so your. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Kentucky paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. For example if an employee earns 1500. Payroll calculator georgia 2023 Kamis 08 September 2022 FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. It can also be used to help fill steps 3 and 4 of a W-4 form. Free Unbiased Reviews Top Picks.

Updated for the 2022-2023 tax year. How to calculate annual income. Regarding the pay rates this calculator produces for grades gs-1 through gs-4 for locations within the united states please be aware that beginning on the first day of the first applicable pay.

Features That Benefit Every Business. Simply enter their federal and state W-4 information as. Deadline Calendars 2021 - 2022 Smart HR 2022 - 2023 Smart HR Calculator GO to Calculator Stipend Listings 2021 - 2022 2022 - 2023 2023 - 2024 2024 - 2025 2025 - 2026.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state. Free Unbiased Reviews Top Picks. Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t-1 t-2 bt-4 t-4 bt-5 t-5 bt-6 bt-7 t-7 fy22 initial years.

Prepare and e-File your. Enter your salary or wages then choose the frequency at which you are paid. Ad Payroll Made Easy.

Ad Payroll So Easy You Can Set It Up Run It Yourself. For all your hourly employees multiply their hours worked by the pay rate. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

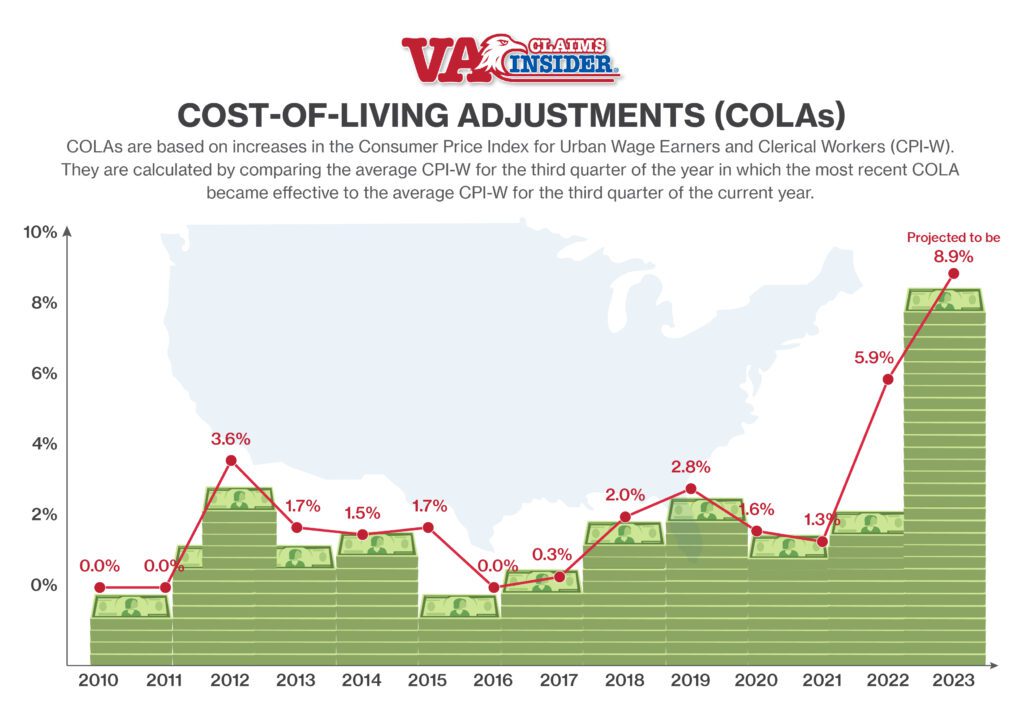

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

2

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Companies Plan To Give Big Raises In 2023 Amid Inflation Money

New 2023 Land Rover Range Rover Reviews Pricing Specs Kelley Blue Book

Cola Prediction What Is The Expected Ss Cola For 2023 Marca

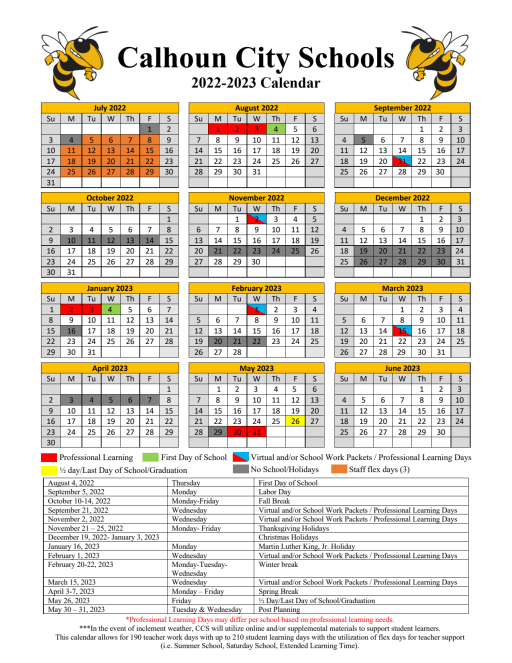

2022 2023 School Calendar

Estimated Income Tax Payments For 2022 And 2023 Pay Online

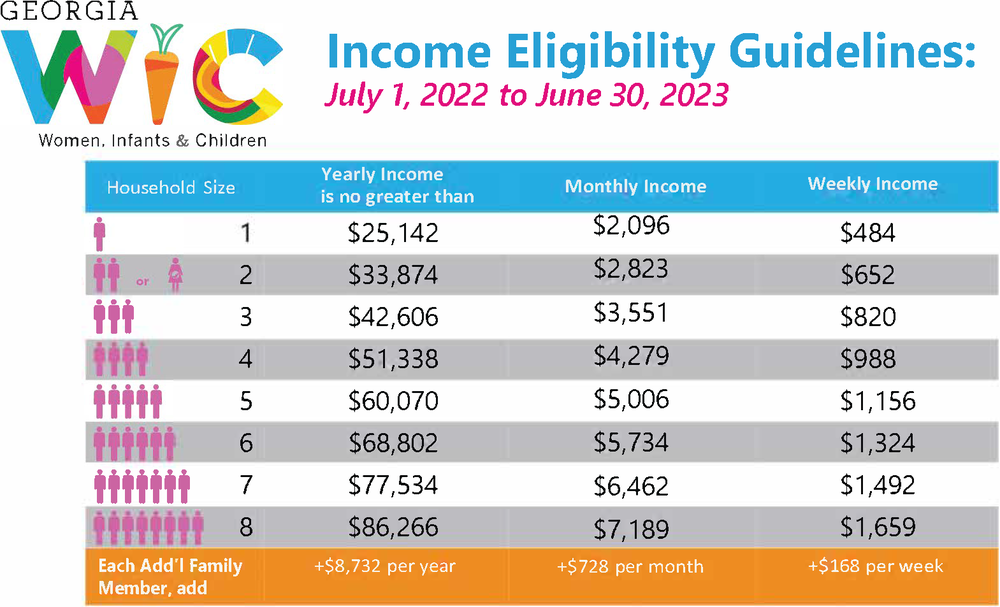

Eligibility Income Guidelines Georgia Department Of Public Health

2023 Kia Sportage Hybrid Prices Reviews And Pictures Edmunds

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2023 Toyota Sequoia Specs Pre Order Release Date

When Is Social Security Increase For 2023 Announced Cola May Be Most In 40 Years Oregonlive Com

Georgia State University Holidays 2020 Georgia State University Georgia State State University